Potential customers are frequently asking whether payslips could – or should – be distributed digitally via an HR software system.

The answer is YES. Digital payslips, also known as electronic or online payslips, are becoming increasingly common as a way to distribute and access pay information.

We’re big advocates of using your people management platform to do this. Here are some key points and a few issues to consider if you make the switch.

Are Digital Payslips Legal

In many countries, they are.

In Ireland, payslips can legally be either electronically distributed or issued in paper format. The Revenue Commissioners accept electronic payslips and P60s, as do banks and financial institutions.

It's the same for HMRC in the UK. In fact, most jurisdictions accept them as valid proof of earnings and deductions.

Some countries do have specific regulations regarding how digital payslips are provided and secured, so it's always worth double-checking.

What are the Benefits of Digital Payslips

Savings in admin time, print machinery, paper and mailing costs aside, digital payslips are more environmentally friendly.

They’re also better for the growing trend of remote workers to have a convenient method to receive salary statements, via any device.

There are also significant privacy and security advantages too, especially important in the age of GDPR.

A slip delivered to the wrong person’s desk that another employee inadvertently views is considered quite a serious breach that’s reportable to a company’s Data Protection Officer and must be registered.

The same goes for emailing the wrong slip to the wrong person; so make sure there’s an additional layer of security, such as a login to the HR system to view and acknowledge receipt.

Our advice is, don’t just use your system to distribute digital payslips because it’s cheaper, easier or faster. Security and convenience for your employees are just as important. Plus, your team are then taking responsibility for filing and keeping their records following each payroll issue.

Additionally, if you have a constantly changing headcount with seasonal or temporary and short-term employees – that might be harder to track down after their time with you has finished – you’ll be able to fulfil your obligations easily via this kind of automation.

Tips for Distributing Digital Payslips

- Use an easily readable format – PDFs are pretty universal and, crucially, cannot be edited or manipulated.

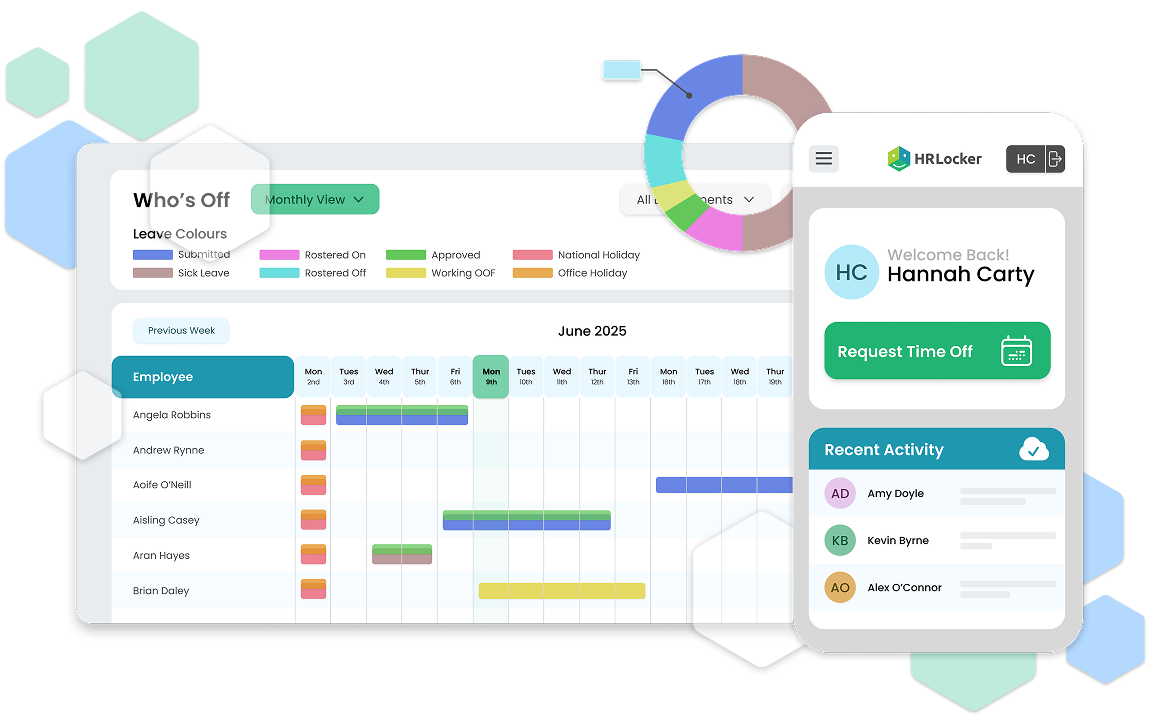

- Ask your team to validate their receipt and acceptance – This is something email cannot do, and that you can't report on without a suitable system. HRLocker’s HRDocs ‘Essential Documents’ digital ‘received and read‘ confirmation, which timestamps the acknowledgement, is a reportable solution that makes it easy to see who has and hasn't received and checked theirs.

- You must allow employees to query their statements. The likelihood is that, as they’re on an electronic device, they’ll do this digitally instead of knocking on a door. Of course, they won’t confirm their acknowledgement until any issues are resolved.

- Inform staff that you can provide access to print copies on demand. This may be necessary if they need to prove their earnings or share their payslip with a third party that only accepts hard copies, so let them know this won't be a problem in advance.

- Consider employee access – Consider whether a work email address is an appropriate way for them to access their payslip. And ensure you have a policy in place that deals with access to archived and historical payslips once they leave the organisation.

- Ensure employees can still receive and access payslips during extended leave periods – If an employee has stepped away from the organisation for a protracted period, such as a sabbatical or gap year, and their logins have been suspended, they'll still need to be able to receive and access their payslips.

3 min read

3 min read

August 22, 2018

August 22, 2018